Loan Products

Making your plans a reality

Trading Loan

This is opened to traders and enterprises seeking to expand their businesses and increase working capital.

Church Loan

This loan product is designed to assist the well-recognised churches to obtain funds for developmental projects.

Educational Loan

Specifically designed to cater for educational needs of students and workers.

Salary Loan

Available to all salary earners and it can be used for varying purposes provided salary can support it.

Susu Loan

It is a microfinance product designed for susu contributors, petty traders among others that seeks to reduce hardship in their businesses.

Funeral Loan

This is open to our distressed bereaved customers of the bank who are in need of an instant loan for the funeral arrangement and to pay their last respects to the deceased.

Pension Loan

Available to all pension earners of the Bank, it can be used for varying purposes provided the pension stipends can support it.

Overdraft

This is open to all current account holders by allowing a deficit in their bank account by drawing more money than the account holds.

Salary Advance

This is available to all salary earners of the Bank to access advances and provides deferred payment option for applicants.

Micro Finance Scheme

This type of product is for customers who are petty traders

and cannot afford collateral security.

Repayment is on weekly or bi-weekly basis, with membership between four (4) and twenty (20)

The maximum duration is six (6) months

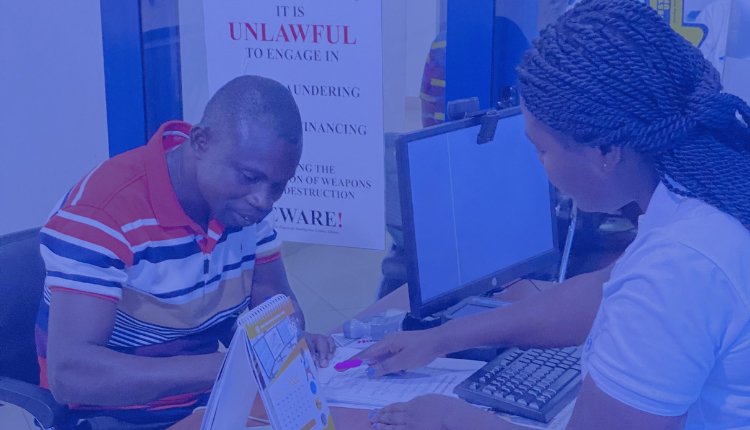

Deposit Products

Put your money where your values are

Savings Account

Designed for people to save money

and also earn interest on their savings every month.

This account is suitable for salaried workers, businesses,

families, groups and clubs among others.

Susu Account

This is tailored to meet the needs of market women, traders, commercial

transport drivers among other clients who are willing to deposit on daily or weekly basis.

A field cashier(mobile banker) visits the customers for daily collection of money.

Current Account

This account is suitable for individuals and businesses.

Allows the account holder to deposit and withdraw at any time during banking hours.

It is also suitable for making payment to creditors by using cheques.

Fixed Deposit

Provides investors with a higher rate of interest than a

regular savings accounts, until the given maturity date.

The period of fixed deposit ranges from 91 days (3 months) to 365 days (1 year)

Corporate Account

This account is suitable for enterprises and businesses.

It allows you to enjoy short term borrowings (overdraft) as well as

loans, cheque payments, cash deposits, funds transfer, bill payment, inter-bank transfer.

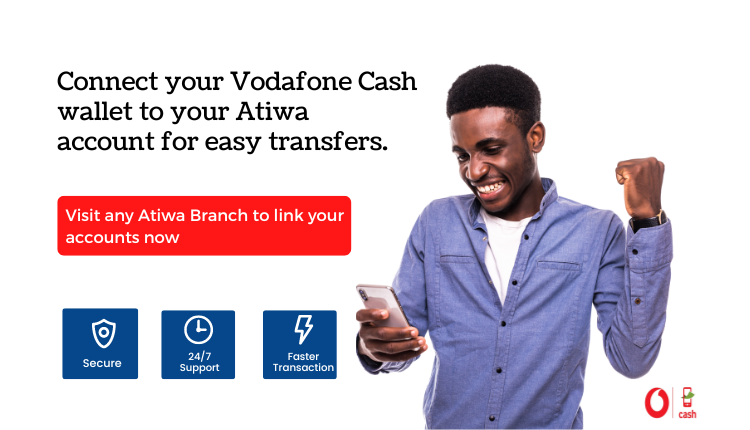

Mobile Banking

Banking-on-the-go

MMI-Mobile Money Interoperability

Visit any Branch of Atiwa Rural Bank and request for your account to be linked

Dial Vodafone Cash Code *110# and follow the prompts to make a transaction

GhanaPay

1. Download the GhanaPay app from Play/App Store or dial *707# to register

2. Select ARB Apex Bank as your Bank

3. Select Atiwa Rural Bank as your Branch

4. Vist any of our Branches for your account linkage and validation

Everyday Banking

Other services offered